EXXON: A DIVIDEND, COMPANY, AND PLANET AT RISK

Exxon’s current direction is premised on outdated assumptions about high oil prices, demand, and margins that are incompatible with the reality of climate change and the inevitable transition to renewable energy sources. As a result, Exxon continues to make massive capital investments in projects that will, in our view, destroy shareholder value and that operate inefficiently, exacting a toll on profitability. To support these investments and an unsustainable dividend, the Company today is burdened with the highest debt levels in its history. We are concerned that shareholders’ dividends have never been more at risk.

A FINANCIALLY UNSUSTAINABLE PATH

Once the most innovative leader in the industry and a pillar of the Dow Jones, Exxon today finds itself lagging behind other oil majors. The industry's new leaders have adapted their strategies to lead the global energy transition. Exxon's failure to do the same threatens its long-term viability. And, because of the Company’s alleged efforts to deny climate change and unwillingness to mitigate its own climate impact – let alone disclose it – we believe Exxon’s current strategy and leadership also represent a real and present threat to our planet’s survival.

A FAILURE OF LEADERSHIP AND VISION

Exxon’s precarious situation cannot be attributed solely to external forces and factors, but also to a failure of leadership and vision. The current Board and management have overseen a decade of shareholder value destruction, underperforming direct competitors in a sector that is underperforming the entire market.

THE WRONG BOARD

Until February 2021, when under pressure from shareholders the Company elected its only director with oil & gas experience and non U.S. residence, Exxon’s Board had zero independent directors with expertise in the Company’s core business areas – energy and oil & gas. Moreover, the Board of this very global company only included residents of the US – a gaping hole given the diverging global regulatory approaches to the energy transition. How can Exxon's current directors ask the right questions and oversee management?

Insular, Entrenched Management

Exxon’s executive team has had no outside energy experience since the 1990s. Except for the newly-appointed General Counsel, each of Exxon’s 15 other executive officers have been at the Company since at least 1998, with tenure ranging from 22 to 42 years.

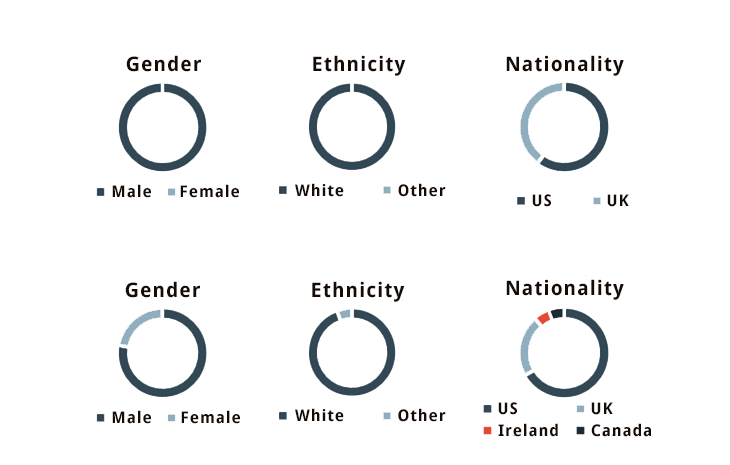

Diversity also remains a problem. Each of Exxon’s top 5 executive officers is male, White, and Anglo-American – as is the substantial majority of the 16-person executive team.

Without diverse experience or backgrounds, it’s no surprise that the leadership team may lack the perspective and creativity to innovatively respond to changing market realities.

A SUSTAINABLE PATH FORWARD

On behalf of over 135 institutional stakeholders in Exxon, which collectively represent more than $2.27 trillion in assets, CURE urges the Company to embrace change with the ingenuity and rigorous analysis for which it was once known, ensuring that Exxon will not only survive but will lead through this inevitable transition.

We are pleased to see other significant shareholders urge the Company to reform its priorities and operating goals, with an eye toward much-improved financial performance, responsible growth in the clean energy transition, and improved environmental stewardship. We hope the Company will address these concerns substantively and engage with those owners, CURE, and all stakeholders, with an earnest desire to improve Exxon for the benefit of all of us.